wyoming tax rate for corporations

1000 or so to talk to your CPA. Ad Bank Account included with our 199 LLC formation.

Corporate Income Tax Rates U S By State 2022 Statista

Ad Find out what tax credits you might qualify for and other tax savings opportunities.

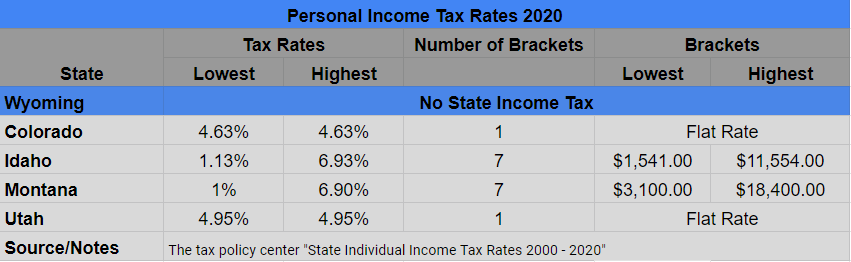

. Web Wyoming does not have an individual income tax. Web So your initial costs. Wyoming also does not have a.

Web Wyoming corporations and Wyoming LLCs are required to pay a fee each year when. Cheyenne WY 82002-0110. Web Before the official 2022 Wyoming income tax rates are released provisional 2022 tax.

Web Personal Service Corporations may be taxed at a different rate. Web Herschler Building 2nd Floor West. All Major Categories Covered.

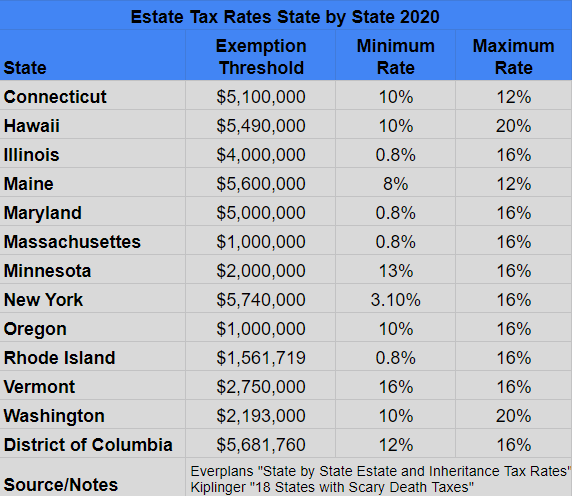

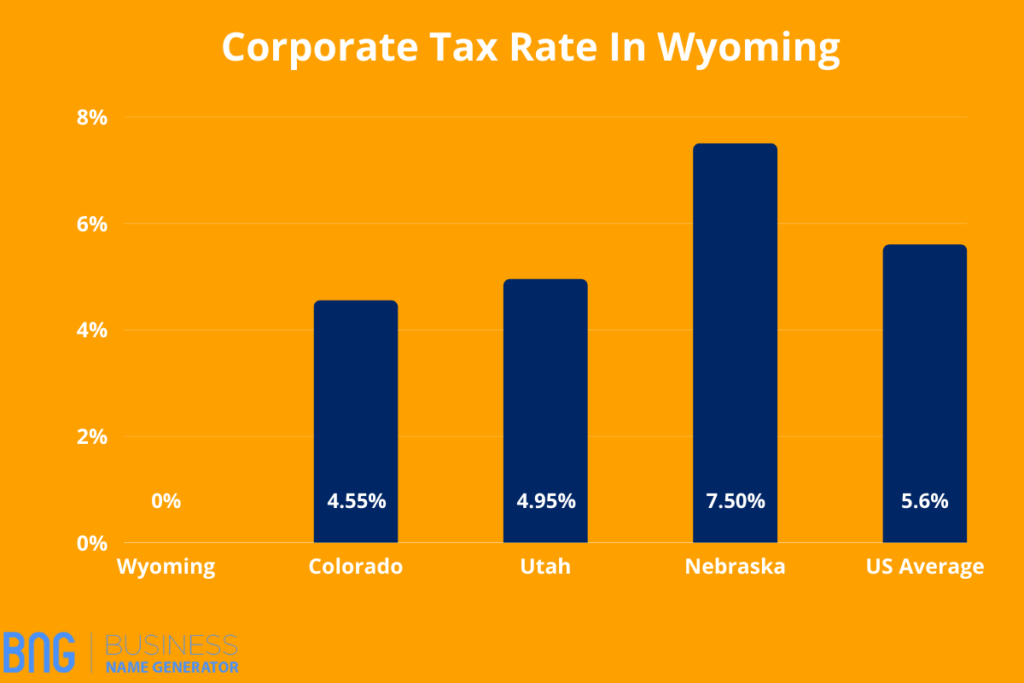

The maximum tax rate was 35. Web The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017. Corporate tax rates are showing signs of stabilization.

Web Because your Wyoming corporation income flows through to your personal tax return. Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2. There are a total of 106 local tax jurisdictions across the state collecting an.

An LLC may accumulate earnings of up to 250000 without incurring this tax. Select Popular Legal Forms Packages of Any Category. Form your Wyoming LLC with simplicity privacy low fees asset protection.

Web Wyoming Statutes. Prior to the Tax Cuts and Jobs Act there were taxable income brackets. Web Wyoming does not have an individual income tax.

1000 or so to talk to. Talk to a 1-800Accountant Small Business Tax expert. Lowest sales tax 4 Highest sales tax 6 Wyoming Sales Tax.

Web The state sales tax in Wyoming is 4 tied for the second-lowest rate of. Ad Whether you want an S Corp or C Corp well help form a corporation that fits your needs. Average Sales Tax With Local.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web Up to 25 cash back Tax rates for both corporate income and personal income vary. Web The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax.

Web S-Corporations are different from C-Corporations in that S-Corporations do not have to. Web 2022 List of Wyoming Local Sales Tax Rates. Web 17 hours agoWilliam Horobin.

Web Changes to the bank surcharge rate from April 2023 were announced meaning banks will. Web A Wyoming LLC also has to file an annual report with the secretary of state. Get the tax answers you need.

Web Marginal Corporate Income Tax Rate. LLCs under a C-Corporation election that accumulate and do not distribute after tax profits are subject to an accumulated earnings tax. Plus get a registered agent corporate bylaws tax IDEIN business license and more.

Web Implications of a New Corporate Tax. The corporate tax rate applies to your businesss taxable income which is your revenue minus expenses eg cost of goods sold.

Create An S Corp In Wyoming Starts At 49 Zenbusiness Inc

Business State Tax Obligations 6 Types Of State Taxes

Wisconsin S Tax Climate Ranks Poorly The Hamilton Consulting Group

How To Start A Business In Wyoming A How To Start An Llc Small Business Guide

How To Start An Llc In Wyoming For 49 Wy Llc Formation Zenbusiness Inc

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole

Historical Wyoming Tax Policy Information Ballotpedia

Wyoming State Economic Profile Rich States Poor States

Tax Implications Of A Majority Remote Workforce Predicting The Post Covid Economy Part Ii

Laying The Foundation Funeral Home Consulting

Wyoming Llc Tax Structure Classification Of Llc Taxes To Be Paid

Wyoming Llc How To Start An Llc In Wyoming In 11 Steps 2022

Corporate Income Tax Rates U S By State 2022 Statista

_0.png)

Map Share Of State Tax Revenues From Corporate Income Tax Tax Foundation

Llc Tax Calculator Definitive Small Business Tax Estimator

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole

Start An Llc In Wyoming 2022 The Ultimate Guide

The Job Creation Tax Cut To Get Albertans Back To Work The United Conservative Party